Greener grass appears to be growing outside of the U.S. Attractive valuations, the prospect of easing global financial conditions coupled with fiscal support, and a drop in the US Dollar have been key catalysts behind the outperformance of international stocks this year. Concerns over slowing domestic growth, exacerbated by trade policy uncertainty and speculation over a peak in American exceptionalism, have further added to rotational pressures abroad.

The landscape for America’s tech sector — the primary engine driving years of consistent U.S. outperformance — may also be changing. After years of being rewarded with asset-light business models, many tech companies have splurged on capital expenditures related to artificial intelligence (AI). While this spending was considered table stakes among the hyperscalers (and welcomed by investors in 2024), the introduction of new, more cost-efficient AI models built outside the U.S. has left many wondering if all the spending was necessary.

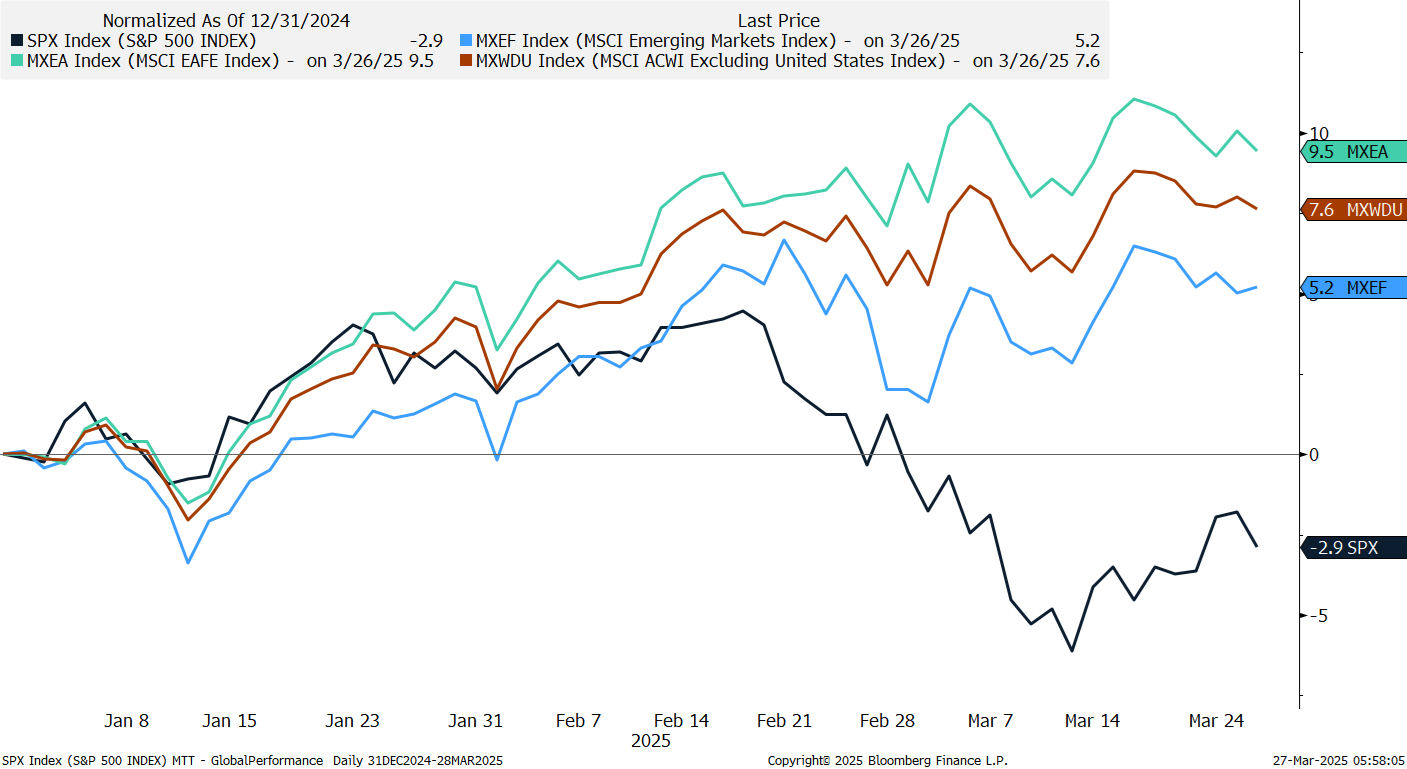

The adage of “Money goes where it’s treated best” may be the simplest explanation behind recent outperformance in international stocks. As highlighted below, the MSCI All Country World Index (ACWI) ex U.S. is up 7.6% year-to-date, while the MSCI EAFE ETF (NYSE: EFA ) (EAFE) has rallied 9.5% this year, as of March 26. Both indexes are also within 3% of record-high territory, compared to the S&P 500 , which recently fell to correction territory.

U.S. Equity Markets Are Underperforming This Year

Is American Exceptionalism Over?

LPL Research does not subscribe to the notion that American exceptionalism is dead. Here are a few key reasons:

- First, the U.S. economy stacks up relatively well when compared to the rest of the world. Even after some downward revisions — mostly attributed to expectations for a higher effective tariff rate and a downshift (not a collapse) in consumer spending — real gross domestic product ( GDP ) is expected to grow around 1.7% and 1.9% in 2025 and 2026, well above respective Eurozone growth forecasts of 0.9% and 1.2%. And while the recent passage of Germany’s landmark infrastructure and defense spending bill has helped renew optimism within Europe’s largest economy, they are coming from a weak starting point marked by two straight years of negative growth.

- Second, the U.S. labor market is on firm footing. The unemployment rate is expected to reach 4.2% this year, a modest increase from 4.0% in 2024. This compares to Eurozone unemployment forecasts of 6.4%.

- Third, corporate earnings expectations are holding up well in the U.S. The S&P 500 is forecasted to grow earnings by around 10% this year, outpacing EAFE earnings growth expectations of 6.4%, according to Bloomberg. Tariffs also don’t change our expectation that the U.S. will deliver superior profit growth relative to the rest of the world in 2025.

- Furthermore, President Trump’s “America First” strategy and the prospect of additional pro-growth policies, including tax cut extensions, deregulation, and a more level playing field in global trade, should help support the appeal of U.S. equities, offsetting the near-term headwinds from tariffs and lower immigration.

- And last but not least, America has a long track record of leading technological innovation and adapting to global competition. The introduction of new AI models such as China’s DeepSeek may have cooled some of the exuberant AI enthusiasm, but we do not believe it marks the end of the story for U.S. technology leadership. More efficient models could help lower barriers to entry, reduce energy requirements, and drive demand and broader adoption rates.

Can Global Stocks Continue to Outperform?

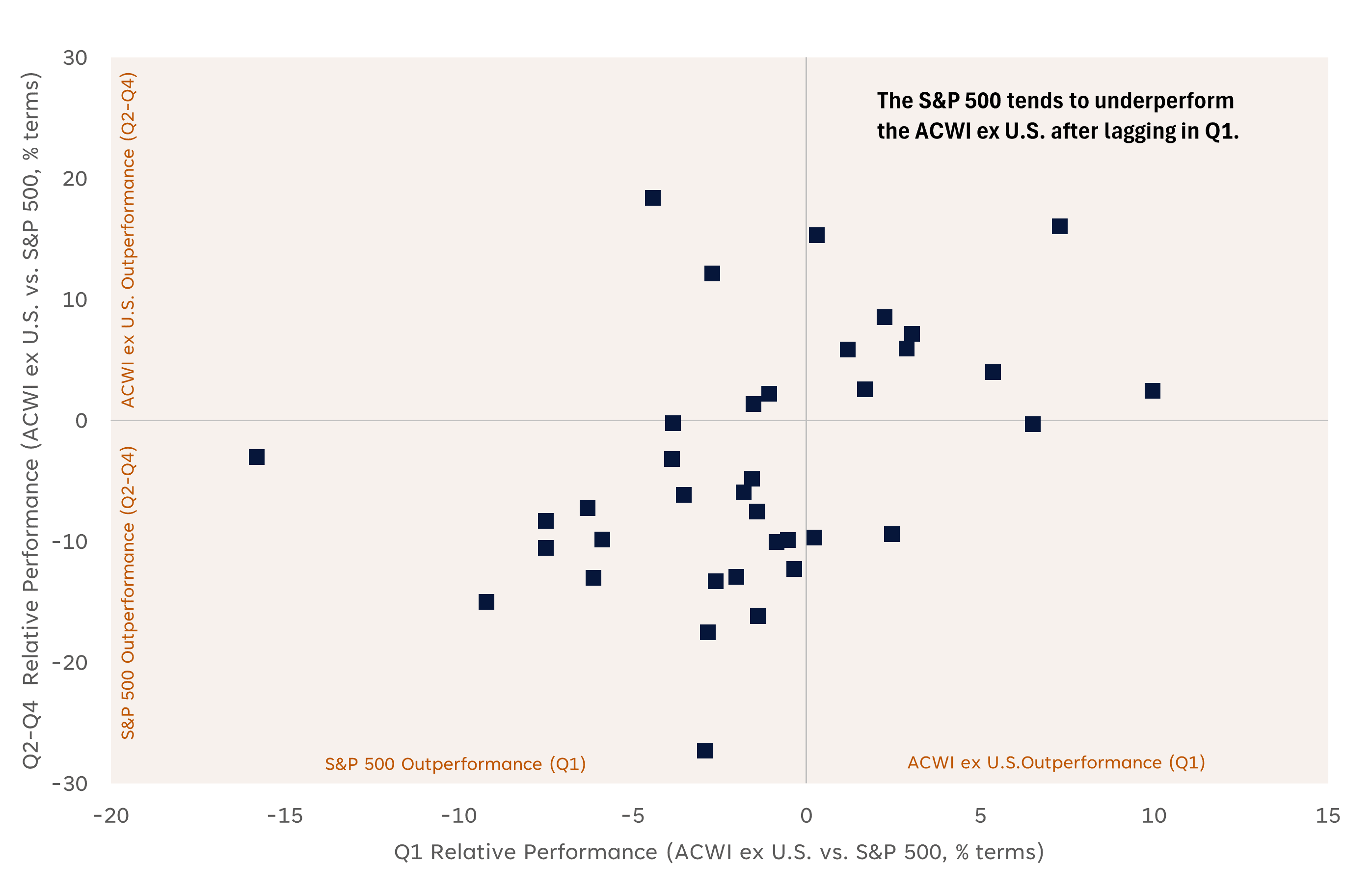

As of March 26, the ACWI ex U.S. is outperforming the S&P 500 this year by 10.5%, potentially marking a record Q1 performance gap. History suggests this leadership trend could continue. Since 1988, the ACWI ex U.S. has only beaten the S&P 500 in Q1 12 times. During these periods, the index outperformed the S&P 500 by an average of 4.0% for the remainder of the year (Q2 through Q4), with nine of the 12 periods producing positive relative performance.

ACWI ex U.S. vs. S&P 500 Q1 Relative Performance vs. the Rest of Year

A Positive Q1 Would Be a Bullish Seasonal Signal

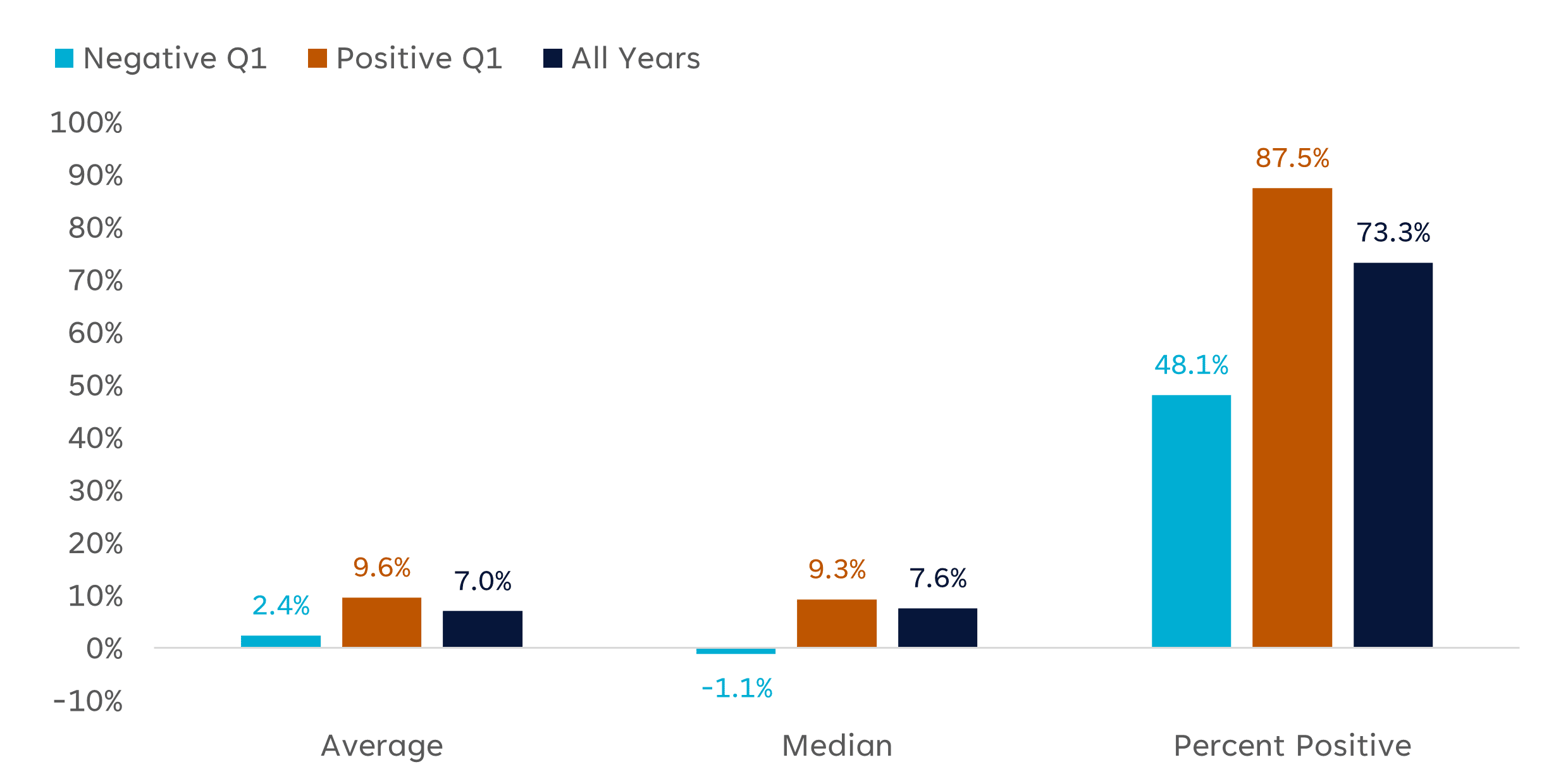

While history may give the edge to international outperformance this year, there are a few more trading days left for the S&P 500 to pare its 2.9% decline. Since 1950, when the index finished Q1 in positive territory, the average and median return for the rest of the year was 9.6% and 9.3%, respectively, with 88% of periods posting positive results. This compares to respective average and median rest-of-year returns of 2.4% and -1.1% when Q1 is negative, with only 48% of years producing positive results.

S&P 500 Q2–Q4 Returns Based on Q1 Performance (1950–2024)

Summary

Stocks are struggling to find solid footing against a backdrop of tariff policy uncertainty and slowing growth projections. Damage to sentiment has expanded beyond the investor class, as survey data continues to show that consumers and businesses are becoming less optimistic about the economy. Fortunately, hard economic data is holding up relatively well, while deregulation, tax relief, and more accommodative monetary policy could help mitigate the adverse effects of higher tariffs. We currently view the recent market correction as a temporary growth scare, unlikely to lead to a recession.

We maintain a tactical neutral stance on equities, with a preference for the U.S. over emerging markets, growth over value, and large caps over small. However, we do not rule out the possibility of additional short-term weakness, as the pace of growth is cooling, and trade policy and geopolitical uncertainty remain high. While the risk-reward trade-off for beaten-down stocks has clearly improved, a swift and sustainable recovery seems unlikely under the cloud of trade uncertainty. We continue to monitor tariff news, economic data, earnings estimates, and various technical indicators to identify a potentially attractive entry point to add equities.