POUND STERLING ANALYSIS & TALKING POINTS

- BoE sentiments keep downward pressure on sterling.

- Fed officials will be the primary focal point for today's US trading session.

- GBP/USD pullback may be short-lived.

GBPUSD FUNDAMENTAL BACKDROP

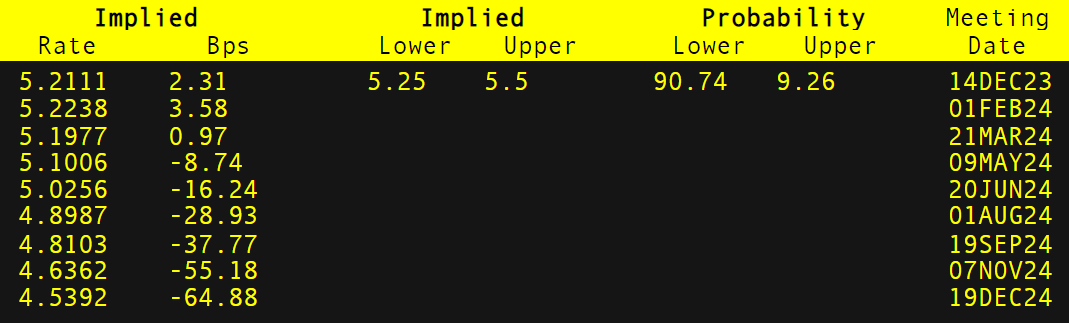

The British pound was not helped by Bank of England (BoE) Governor Andrew Bailey today as he reiterated the sentiments stated by the BoE Chief Economist Huw Pill that inflation is expected to fall sharply – as seen with the Euro area earlier today. That being said, the Governor stuck to a ‘higher for longer' message with forecasts of inflation estimated around the two year mark. Overall, money markets have been ‘dovishly' repriced with no further hikes and an increase in cumulative interest rate cuts to by December 2024 up from just a week ago (refer to table below).

BoE Governor Bailey:

BOE INTEREST RATE PROBABILITIES

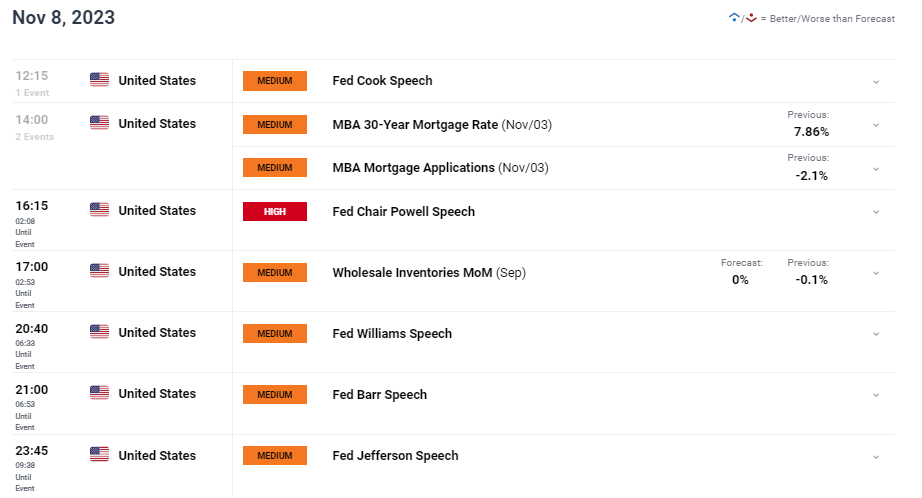

The rest of the trading day will be US centric (see economic calendar below) with Fed speak in focus. Certain Fed officials have maintained a hawkish narrative but markets will emphasizes the message delivered by Fed Chair Jerome Powell. While little is expected from Mr. Powell around monetary policy today, tomorrow's address will likely carry more weight. Other Fed officials will be scattered throughout and will give investors an overall picture of the Fed's vision. I expect the broader rhetoric to remain on the hawkish side thus limiting GBP upside.

Weak Chinese data has supplemented a weaker pound and will be a key component to monitor moving forward.

GBP/ USD ECONOMIC CALENDAR (GMT +02:00)

TECHNICAL ANALYSIS

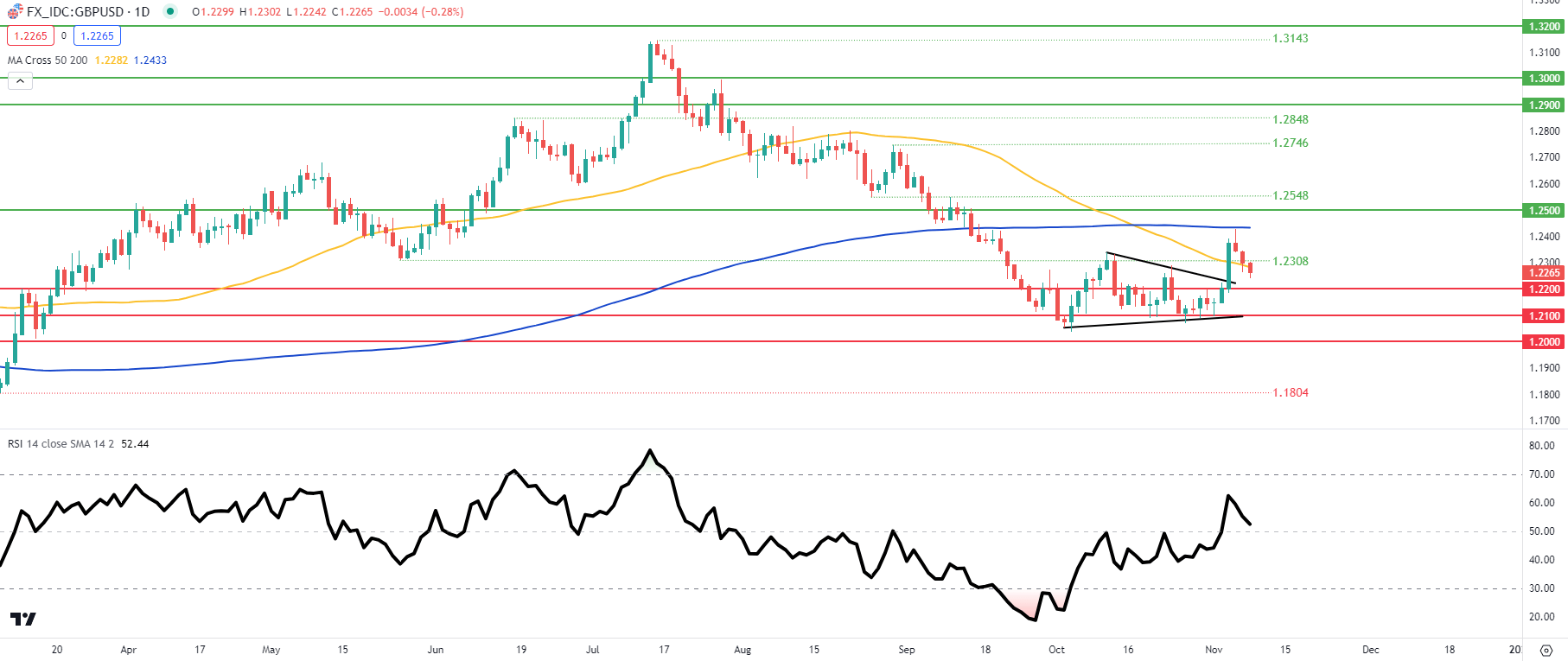

GBP/USD DAILY CHART

Chart prepared by Warren Venketas , IG

GBP/USD price action above shows the significance of the 200-day moving average (blue) and the long upper wick candle formation respectively. Cable has since dropped below the 50-day MA (yellow) and could head towards the psychological handle. The medium-term bias (based on my analysis) stays in favor of more downside to come should market conditions stay relatively consistent.

- 200-day MA (blue)

- 1.2308/50-day MA (yellow)

- 1.2200

- 1.2100

- 1.2000

- 1.1804

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net on GBP/USD with of traders holding long positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Start Course