President Trump says he doesn’t plan to fire Federal Reserve Chairman Powell, but the calls for rate cuts continue. The central bank, however, is expected to leave rates unchanged at the next month’s policy meeting. For the moment, it’s still a battle of the unstoppable force vs. the immovable object.

Speaking to reporters in the Oval Office on Wednesday, Trump said “I might call [Powell]. I haven’t called him, but I believe he’s making a mistake by not lowering interest rates. He will hopefully do the right thing. The right thing is to lower interest rates.”

If this was an exercise in changing market expectations, it’s not working. At least not yet. The Fed funds futures market this morning is pricing in a 94% probability for no change in the target rate at the upcoming May 7 FOMC meeting . The outlook for Trump’s preference offers better chances in June, which shows a modest 59% probability for a cut.

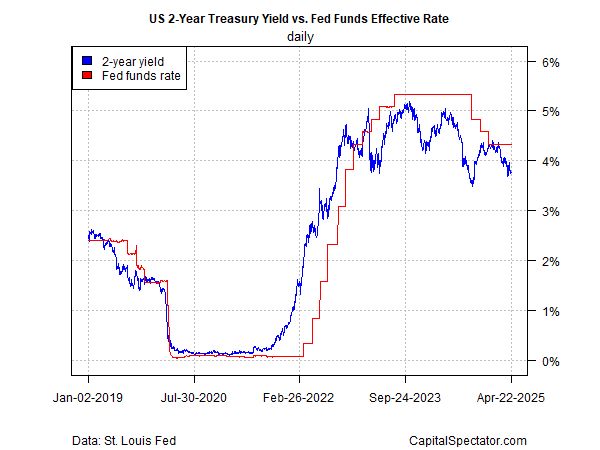

The policy-sensitive US 2-year Treasury yield is anticipating a rate cut at some point. The recent slide in this maturity has left the 2-year yield at 57 basis points below the current median 4.33% Fed funds target rate — a clear sign that the crowd is looking for cuts.

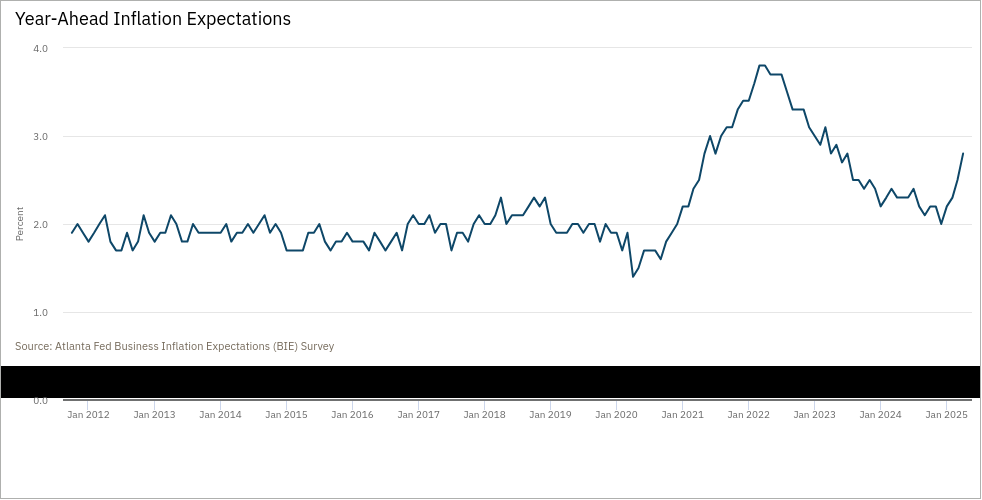

Pressure on the Fed to ease, however, is likely to fall on deaf ears at the central bank until its confident that the runup in inflation expectations is temporary. That’s not obvious in several polls that show forecasts of rising pricing pressure.

The Atlanta Fed’s monthly poll of businesses, for example, indicates that firms continued to lift expectations for the year-ahead inflation rate. For a fourth straight month in April, the outlook ticked higher, edging up to 2.8%, the highest since July 2023.

More worrisome: Consumer inflation expectations are also hotting up. This month’s update of the University of Michigan consumer sentiment survey shows one-year inflation expectations jumped sharply to 6.7% — the highest since 1981 and far above the Fed’s 2% inflation target. Just three months ago, the survey reported that consumers expected inflation at 3.3%.

The Treasury market’s 5-year breakeven rate, however, remains at a middling level vs. recent history at 2.33%, roughly unchanged from the start of the year. The implied inflation forecast leaves room for debating how much pricing pressure is building in the pipeline.

Federal Reserve Chairman Powell last week said: “For the time being, we are well-positioned to wait for greater clarity” regarding policy changes linked to immigration, taxation, regulation, and tariffs.

Meanwhile, the CEOs of three of the nation’s biggest retailers — Walmart (NYSE: WMT ), Target (NYSE: TGT ) and Home Depot (NYSE: HD ) – told President Trump yesterday that his tariffs could raise prices.

At the same time, there are more signs that the US economy is slowing, which could strengthen disinflation. As reported by CapitalSpectator.com yesterday , the median nowcast for first-quarter GDP shows a sharp slowdown in growth. PMI survey data points to a continued slowdown in economic activity in April. The implication: softer economic activity may do the heavy lifting and cool pricing pressure.

The key dynamic to watch is whether slowing growth offsets higher inflation pressure from tariffs. The “greater clarity” that Powell’s looking for isn’t here yet, but the incoming data will likely tip the scales one way or the other.

The joker in the deck is the possibility that neither trend dominates – so-called stagflation. In that scenario, slower growth and higher inflation are roughly equal as offsetting forces, thereby leaving the Fed (and the President) with an extended run of the status quo.