Utah’s Bitcoin bill has passed the state Senate, but without its cornerstone, a clause that would have made it the first US state with its own Bitcoin reserve.

The HB230 “Blockchain and Digital Innovation Amendments” bill now only provides Utah citizens with basic custody protections, the right to mine Bitcoin

The 19-7-3 vote to pass the measure on March 7 means the bill is now headed to Utah Governor Spencer Cox’s desk to be signed into law.

The reserve clause would have authorized Utah’s treasurer to invest up to 5% of digital assets with a market cap above $500 billion over the last calendar year in five state accounts — with Bitcoin as the only digital asset that currently meets this criteria.

The reserve clause passed the second reading but was scrapped in the third and final reading. Utah’s House then concurred with the amendment in a 52-19-4 vote.

“There was a lot of concern with those provisions and the early adoption of these types of policies,” one of the bill’s sponsors, Senator Kirk A. Cullimore, said in Utah’s March 7 floor session.

“All of that has been stripped out of the bill.”

Up until March 7, Utah looked likely to become the first US state to adopt a Bitcoin reserve, Satoshi Action Fund’s CEO Dennis Porter predicted on Feb. 2.

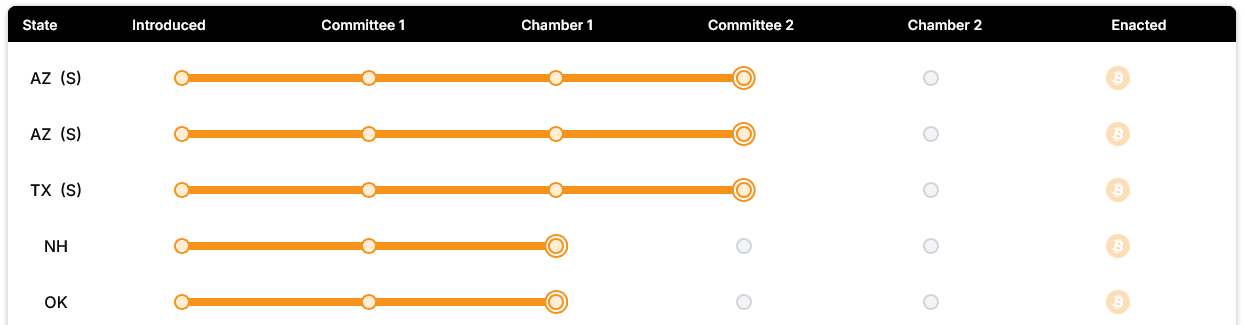

Two Arizona Bitcoin reserve bills and a Texas bill are now the closest to being passed into law, Bitcoin Laws data shows. Each of those bills obtained a successful vote in their respective Senate committees and is now awaiting a final floor vote in the Senate.

Of the 31 Bitcoin reserve state bills introduced, 25 remain live, including bills from Illinois, Iowa, Kentucky, Maryland, Massachusetts, New Hampshire, New Mexico, North Dakota, Ohio and Oklahoma.

Bills from the likes of Pennsylvania, Montana, Kentucky and North Dakota have failed.

Related: Trump’s World Liberty bought $20M worth of crypto ahead of March 7 summit

It comes as US President Donald Trump signed an executive order establishing a federal Strategic Bitcoin Reserve on March 7.

The Bitcoin reserve will be seeded with Bitcoin obtained through forfeitures in criminal cases, while the Treasury and Commerce secretaries has been instructed to develop budget-neutral strategies to buy more Bitcoin.

Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions