It was another turbulent trading session yesterday, marked by heightened volatility and a rush to exit US assets. The dollar index dropped roughly 1.1%, the S&P 500 declined by about 3%, and the 10-Year Treasury yield rose by eight basis points. The key question now is how much further this can go—and honestly, I don’t have a definitive answer.

What I can say is that the dollar will likely serve as a guide. Stocks probably won’t stop declining until the dollar stabilizes.

Even more specifically, it’s a question of when currencies like the

Japanese yen

and

euro

stop strengthening. Given where

USD/JPY

was trading yesterday, the move might still have considerable room, especially since USD/JPY is once again approaching critical support in the 140 to 141 range. If that support breaks, we could see significant further strength in the yen.

It’s the same story with the

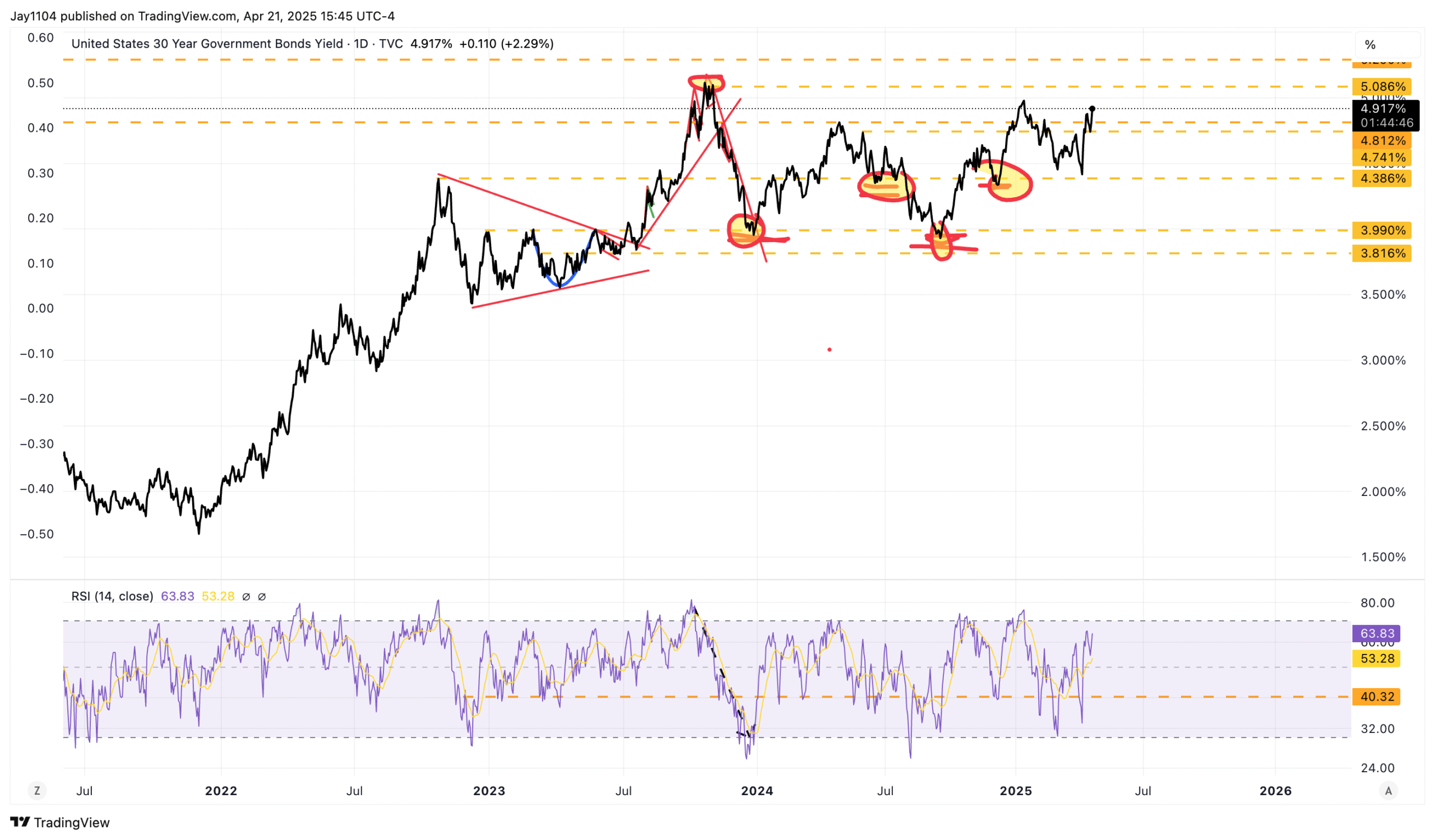

30-year Treasury yield

, which is likely targeting 5%—and possibly even higher.

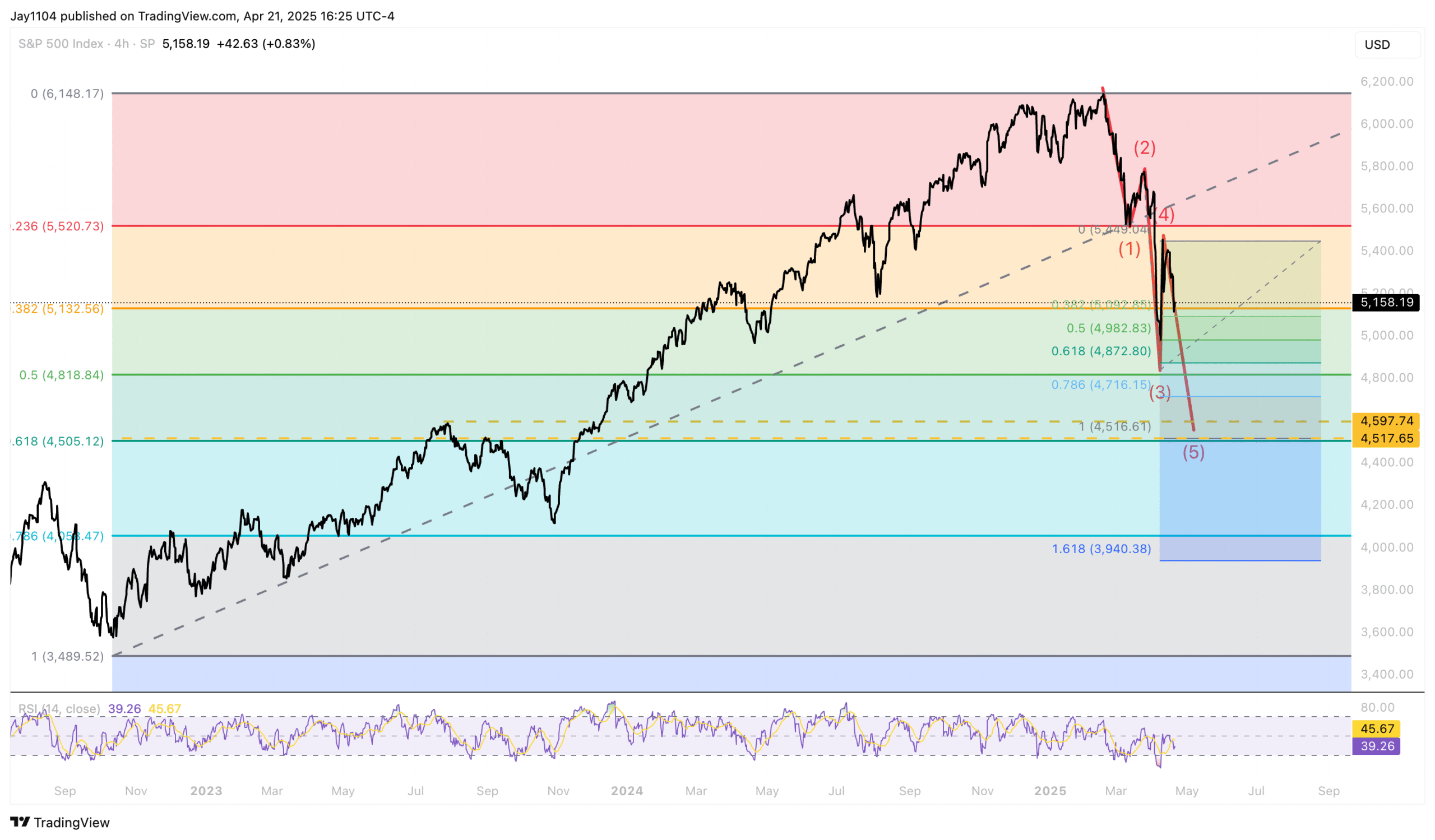

Regarding yesterday’s price action, we traded down to 5,100—the put wall—and tested it twice. My sense is that as the day drew to a close and the index was unable to sustain levels below 5,100, we likely saw put positions being closed out.

(GEXBOT)

That sent implied volatility lower, triggering the end-of-day short-covering rally that helped transform what was nearly a 3.5% loss on the S&P 500 into a more modest 2.4% decline.

Again, I continue to believe we’re currently in wave five down, which could easily carry us well below the lows from April 7. The structure remains consistent, showing sharp, linear impulses lower with very few overlaps. That leaves the path open toward 4,500—though admittedly, a lot would need to align just right for that scenario to play out.

Today is a new day!

Original Post