US stocks slumped. All four major US stock indices ended Monday, 21 April session, deeply in the red. The S&P 500 , Nasdaq 100 , Dow Jones Industrial Average , and Russell 2000 lost 2% or more.

The ’US exceptionalism’ narrative is under threat as US equities, the US Dollar , and Treasuries are being sold off simultaneously. Notably, over the past four weeks, the dollar and Treasuries have failed to act as traditional safe havens during periods of risk-off sentiment, instead behaving more like emerging market assets.

The current rout seen in the US dollar has wiped out all of last year’s gains seen in the US Dollar Index . The US dollar tanked to a 10-year low against the Swiss franc yesterday, and the euro climbed to an intraday high of 1.1573 against the US dollar, its highest level since November 2021.

The continuation of US President Trump’s threats to remove Fed Chair Powell and the growth uncertainties arising from US trade tariffs, coupled with retaliation measures, have benefited Gold.

Gold ( XAU/USD ) surged to another fresh record yesterday with a gain of 2.9%. In today’s Asia opening session, it extended its rally by 0.7% and printed a new intraday all-time high of US$3,453 at this time of writing.

Reuters, according to a source, reported that the Bank of Japan (BoJ) is likely to keep its interest rate hike signal intact despite Trump tariff risks after the conclusion of its upcoming two-day monetary policy decision meeting, ending 1 May.

In addition, the source, as quoted by Reuters, stated that BOJ is likely to downgrade Japan’s current fiscal 2025 economic growth forecast of 1.1% in its updated quarterly report release on 1 May.

After the conclusion of the first round of US-Japan trade talks last week, Japanese Prime Minister Ishiba told parliament yesterday, 21 April, that Japan will not concede to all US demands, citing the need to protect national interests, especially in the automobile and agricultural sectors.

Hence, the second round of trade negotiation talks between the US and Japan to be held before the end of April may not be smooth sailing.

After the sell-off seen in major US stock indices yesterday that led to short-term oversold conditions on several technical momentum indicators, the S&P 500 and Nasdaq 100 E-mini futures have managed to stage a relief corrective rebound of 0.7% each in today’s Asian opening session at this time of the writing.

The Hong Kong stock market reopened after a two-day Easter break, playing catch-up to global weakness. The Hang Seng Index is down 0.7% intraday.

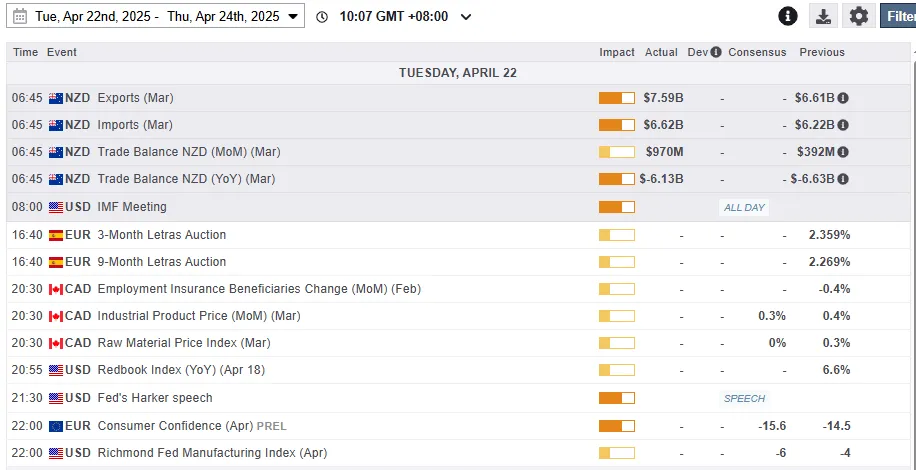

Economic Data Releases

Fig 1: Key data for today’s Asian mid-session

Chart of the Day – Hong Kong 33 at Risk of Further Downside to Retest 200-day MA

Fig 2: Hong Kong 33 CFD Index minor trend as of 22 Apr 2025

Since its recent minor swing high of 21,668 printed on 14 April, the short-term technical conditions of the Hong Kong 33 CFD Index (a proxy of the Hang Seng Index futures ) have deteriorated.

The latest observations seen on its hourly RSI momentum indicator have just flashed out a bearish momentum condition at this time of writing below the 50 level.

All in all, the Hong Kong 33 CFD Index may see a multi-day decline to retest its 200-day moving average. Watch the 21,450 key short-term pivotal resistance, and a break below 20,840 near-term support may expose the next intermediate supports at 20,280 and 19,900 (200-day moving average).

On the other hand, a clearance above 21,450 invalidates the bearish tone to see a squeeze up for the next intermediate resistances to come in at 21,740 and 22,220/22,500 (also the area between the 20-day, and 50-day moving averages).

Original Post