Hermès tops LVMH, how Nvidia (NASDAQ: NVDA ) compares to Cisco (NASDAQ: CSCO ), and European travel to the US tanks. Each week, we take you through the last seven days in seven charts.

1. Hermès Market Cap Surpassed LVMH’s for the First Time Ever

Hermès has overtaken rival LVMH in market capitalisation —a striking turn of events given that the luxury conglomerate once attempted to buy the coveted Birkin bag maker, a move that shocked the French corporate world 15 years ago.

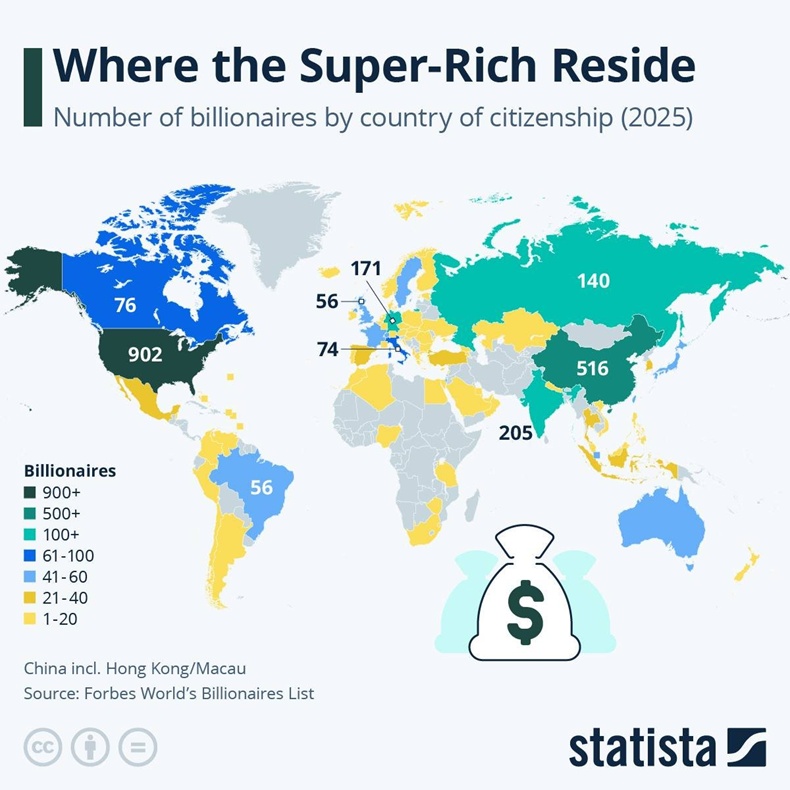

2. Who Owns US Debt?

US Treasury Secretary Scott Bessent in an interview Tuesday, with Yahoo Finance, dismissed concerns that China might weaponise its holdings of US Treasuries amid recent bond market volatility. He emphasised that there is no risk of Beijing leveraging its sizable Treasury reserves to harm the US economy. The numbers appear to back him up—China holds just 2.2% of total US debt, as shown below.

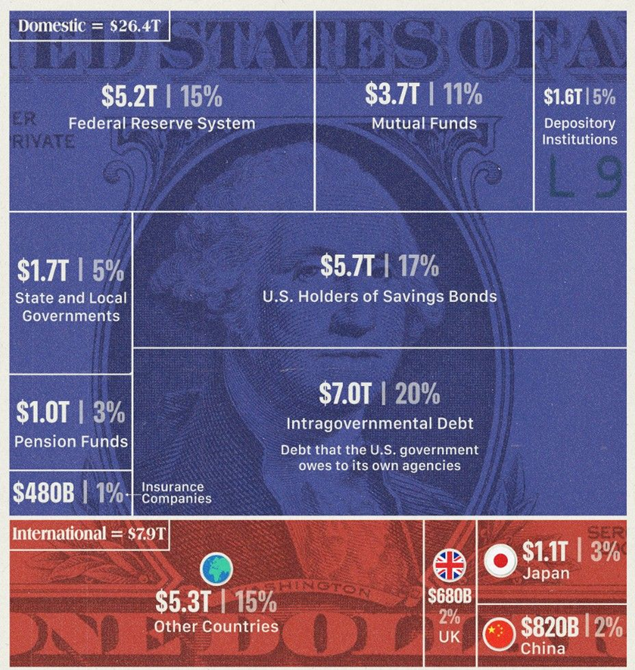

3. Nvidia Vs. Cisco: The Chart That Scares the Market

Could NVIDIA transition from the most hyped to the most hated stock in the world?

During the dot-com bubble, Cisco was the most valuable firm in the world. The stock fell 80% after the bubble popped.

Is this NVIDIA’s “Cisco moment”?!

While the comparison is tempting, Nvidia’s situation differs from what Cisco faced during the dot-com crash in several important ways:

- Business mode differences

Cisco’s business was primarily selling networking hardware infrastructure designed to last several years with minimal upgrades, leading to a demand collapse once the infrastructure was installed. Their model was more static and dependent on cyclical telecom spending.

Nvidia sells computing power and GPUs (graphic processing units) that are essential for AI development, a field with rapidly evolving technology and continuous demand for upgrades and innovation. This creates consistent growing demand rather than a one-time infrastructure buildout.

- Customer base and demand stability

Cisco’s customers were often startups with limited financial resources and the telecom sector, which was smaller and less competitive. This made demand more volatile and speculative.

Nvidia’s customers are large, financially robust tech companies heavily invested in AI, ensuring more stable and growing demand. The competitive pressure to innovate in AI also drives consistent spending on Nvidia’s products.

- Innovation and competitive moat

Cisco faced intense competition and challenges from emerging firms, including intellectual property issues, which eroded its market position.

Nvidia has a strong competitive advantage through its CUDA platform, developed well before competitors entered AI hardware. This creates a significant barrier to switching and competition, supporting sustained market dominance.

- Financial scale and profitability

At its peak, Cisco had much lower net income and margins (less than 15%) compared to Nvidia, which reported significantly higher revenues and net margins exceeding 50%. Nvidia’s financials reflect a more robust and profitable business model.

- Valuation and market context

Cisco’s stock price during the dot-com bubble was vastly overvalued, with a P/E ratio around 200. This led to a severe crash and a long recovery period.

Nvidia’s P/E ratio is much lower (35x), and its earnings and revenue growth have kept pace with its stock price.

In summary, while both companies experienced rapid stock price increases, Cisco’s growth was largely speculative and tied to a hardware business with limited upgrade cycles, leading to a collapse when the bubble burst. Nvidia’s growth is driven by continuous innovation in AI technology, stable demand from financially strong customers, and a strong competitive moat, making its situation fundamentally different from Cisco’s dot-com crash experience.

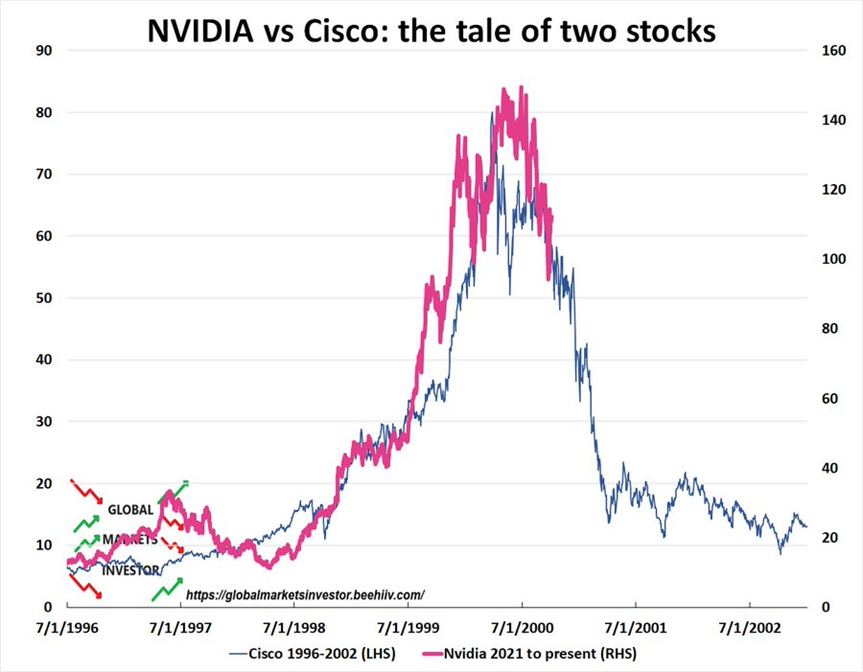

4. Gold Is Now Outperforming the S&P 500 Over the Last 20 Years

Gold is now trading at $3,350 an ounce— a new all-time high—and seems to be saying something is wrong with either the financial system, global economy, geopolitical climate, or both:

Gold prices have risen 26% year-to-date, marking the best performance in over 20 years.

Since the beginning of 2024, gold prices have surged an impressive 58%.

The gold ETF is now outperforming the S&P 500 ETF over the last 20 years. The SPDR Gold ETF (NYSE:

GLD

) is up +619% while the SPDR S&P 500 ETF (NYSE:

SPY

) is up +579%.

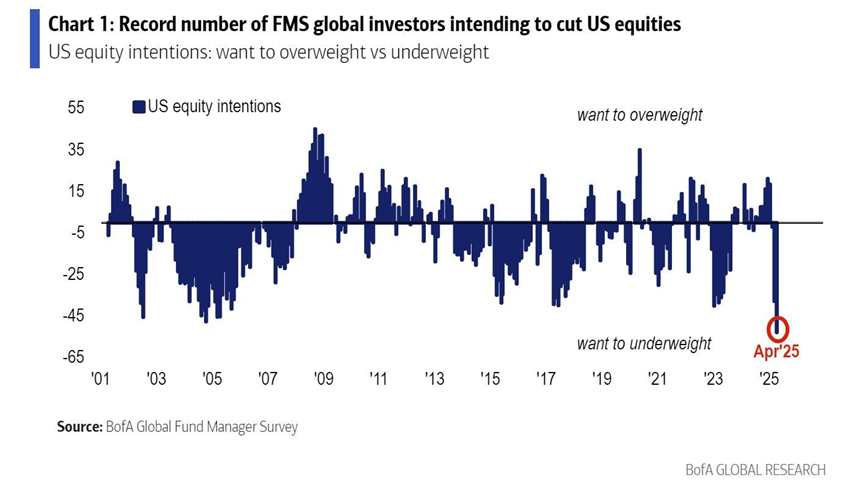

5. Extreme Anti-US Sentiment or Just the Start of a Trend?

The latest BofA Fund manager survey shows a major shift regarding the sentiment towards US equities. Indeed, the intention to underweight US equities is at an all-time high, with nearly 50% of fund managers planning to reduce their exposure.

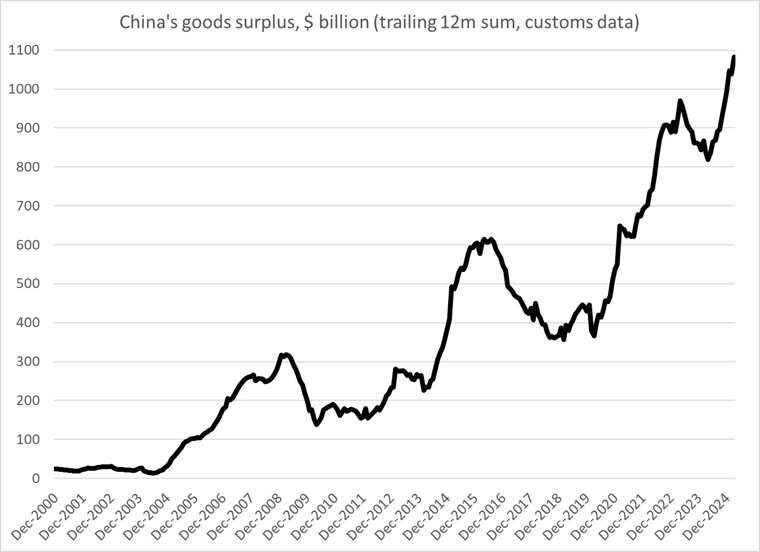

6. Crazy Numbers Coming Out of China...

China posted a $100 billion goods surplus in March, a $275 billion surplus in the first quarter—up from $185 billion a year ago—and nearly $1.1 trillion over the past four quarters. The easy explanation is tariff front-running, but that seems a little too neat. China’s exports to both the United States and the European Union have increased, despite no reciprocal tariff threat from the EU. A similar trend appears with emerging markets, where exports are rising, and imports are falling. There may be more at play than just tariffs.

7. The Number of Europeans Travelling to the US Has Cratered Under Trump