A new world order has emerged in the three weeks since President Trump on Apr. 2 announced “Liberation Day” and rolled out US tariffs. From an investing perspective it’s safe to say it’s been a shock heard around the world, and markets are furiously repricing a new set of risk factors for a radically different outlook for economic activity, financial assets, trade policy, and assumptions about safe havens.

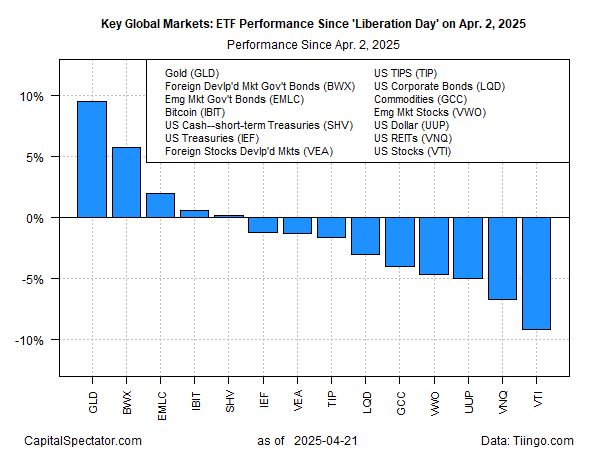

Given the upheaval that’s arrived, it seems reasonable to start tracking the world’s key markets from an Apr. 2 start date. The previous world order suddenly looks like ancient history and is arguably irrelevant for what lies ahead. The chart below summarizes the winners and losers to date since Liberation Day’s start, based on a set of ETFs through yesterday’s close (Apr. 21).

Gold ( GLD ) is the big winner in what might be called the Great Financial Reset. The precious metal has surged 9.7% so far. Government bonds in developed markets ex-US ( BWX ) are a strong second-place winner with a 6.0% rise, followed by bonds issued by governments in emerging markets ( EMLC ) with a 2.1% advance. Bitcoin ( IBIT ) is in fourth place with a modest 0.6% advance. Cash ( SHV ), based on US Treasuries with maturities of 1 year or less, has edged up 0.2%.

The losers in the Great Financial Reset are led by US stocks ( VTI ), which have crashed 9.1%. The other big drawdowns are in US real estate investment trusts ( VNQ ), the US dollar ( UUP ), and stocks in emerging markets (EMLC).

Deciding how long the Great Financial Reset will last, or whether it’s a permanent feature from here on out, is the crucial question. At the moment, debate rages.

What is clear is that the old script is being torn up regarding assumptions about how markets work. Adding to the confusion: Investors are struggling to price in several dramatic changes unfolding simultaneously. The two elephants in the room: tariffs, of course, along with burning questions about the Federal Reserve’s independence in the wake of President Trump’s recent attacks on the Fed Chairman Powell.

There are also crucial macro questions about whether inflation will heat up inflation and slow growth, perhaps triggering a recession for the US in the near term.

Asset allocation is still the only game in town, for a simple reason: There will always be winners and losers. But as the Great Financial Reset reminds, assumptions about the victors and failures aren’t written in stone.