Despite a growing chorus of pundits claiming the “death of the dollar” is imminent, Treasury Secretary Scott Bessent said the US dollar will remain the world’s reserve currency. The following clip from Bloomberg was based on a speech Scott Bessent gave Thursday morning to the IMF and World Bank:

More broadly, the Treasury secretary reinforced backing for the central role of the US and its dollar in the global financial system. “I think that the US will always, for my lifetime, be the reserve currency,” said Bessent, age 62. He also quipped of the global reserve role, saying “I am actually not sure that anyone else wants it.”

Some believe Donald Trump’s economic policies are designed to end the dollar’s role as the world’s reserve currency. Scott Bessent clears up such misinformation, affirming the dollar’s status as the reserve currency. In Trump’s Economic Revolution , we opined on the long-standing Bretton Woods Agreement that made the dollar the reserve currency and how Trump may be steering away from some of the “rules” that evolved since the agreement was signed in 1944.

The agreement and its unwritten rules are economically unsustainable. Trump is rightfully taking action to change them. However, that doesn’t mean he intends to change the dollar’s status as the reserve currency. As we summarized in the article mentioned above:

The dollar will likely remain the world’s reserve currency as no reasonable alternative exists. However, the unspoken agreements and promises surrounding the global economy may change drastically.

What To Watch Today

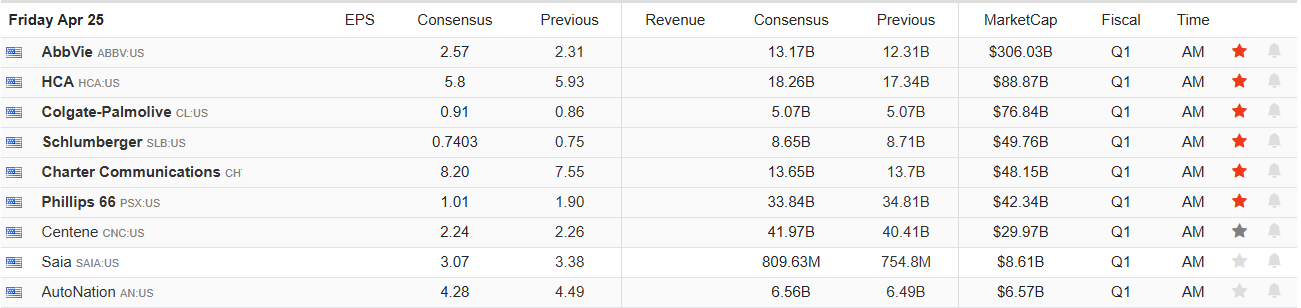

Earnings

Economy

Market Trading Update

This is a snippet from this weekend’s upcoming report :

In

Risk Off Positioning Signaling A Market Low?

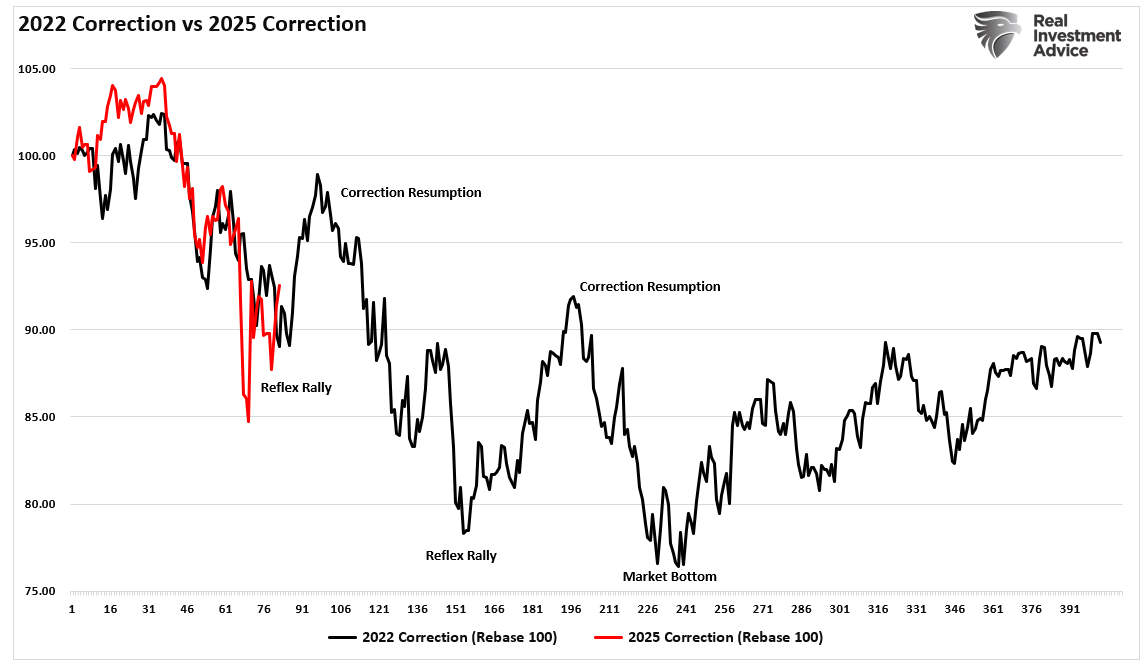

” We discussed the extremely oversold market conditions that are beginning to suggest the market may be approaching a near-term low. That analysis was based on various indicators, including extremely negative investor sentiment, positioning, and technical oversold conditions. As we stated, the current market environment is much like 2022. The first chart below shows the 2022 market correction versus 2025. The rally that began this past week could certainly rally further. Still, as we have warned, any rally in the near term will likely be met with sellers until there is a resolution on tariffs, monetary policy, and more certainty around recession risks.

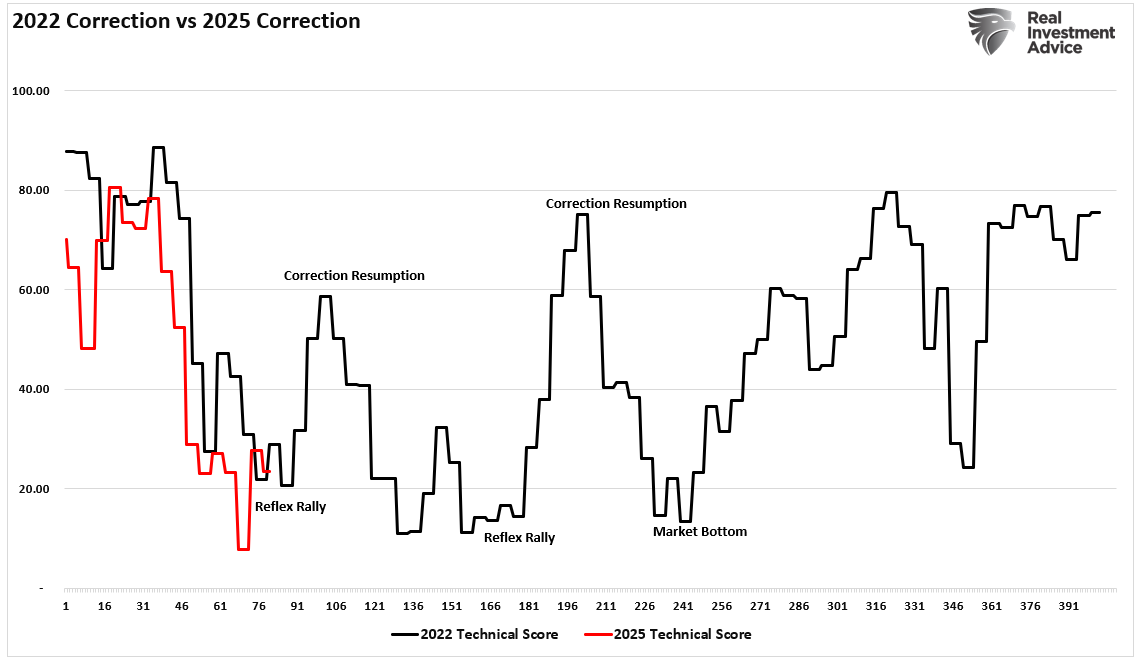

The following chart compares our weekly Technical Composite Index. You will note that when the technical composite reached levels below 20, the market bounced or bottomed.

The current conundrum is whether the extremely low technical readings preceding this week’s rally were a technical bounce or a market bottom. Unfortunately, we won’t know until after the fact. Still, our gut instinct suggests that given the depth of the decline and the technical damage to the market overall, any significant bounce will be met with sellers. Historically, the first market low during a correction phase is not usually a bottom. Regardless, the market continues to follow the 2022 playbook closely this year, but I would not expect the rest of the year to be an exact match.

The optimistic view is that while there are never any guarantees when it comes to investing, history suggests that after such a volatile period, we tend to perform better in the future, barring the onset of a recession or credit-related event. The bad news is that these increases in volatility tend to lead investors to make many emotionally driven investment mistakes. We rationalize, try to avoid losses, fail to take action when needed, or take action when we shouldn’t—all driven by our emotions. Yet being unemotional about your money is crucial to long-term investment outcomes.

As Howard Marks once stated:

“If I ask you what’s the risk in investing, you would answer the risk of losing money. But there actually are two risks in investing: One is to lose money, and the other is to miss an opportunity.

You can eliminate either one, but you can’t eliminate both at the same time.

So the question is how you’re going to position yourself versus these two risks: straight down the middle, more aggressive or more defensive.

I think of it like a comedy movie where a guy is considering some activity. On his right shoulder is sitting an angel in a white robe. He says: ‘No, don’t do it! It’s not prudent, it’s not a good idea, it’s not proper and you’ll get in trouble’.

On the other shoulder is the devil in a red robe with his pitchfork. He whispers: ‘Do it, you’ll get rich’. In the end, the devil usually wins.

Caution, maturity and doing the right thing are old-fashioned ideas. And when they do battle against the desire to get rich, other than in panic times the desire to get rich usually wins. That’s why bubbles are created and frauds like Bernie Madoff get money.

How do you avoid getting trapped by the devil?

I’ve been in this business for over forty-five years now, so I’ve had a lot of experience. In addition, I am not a very emotional person. In fact, almost all the great investors I know are unemotional. If you’re emotional then you’ll buy at the top when everybody is euphoric and prices are high. Also, you’ll sell at the bottom when everybody is depressed and prices are low. You’ll be like everybody else and you will always do the wrong thing at the extremes.

Therefore, unemotionalism is one of the most important criteria for being a successful investor. And if you can’t be unemotional you should not invest your own money, period. Most great investors practice something called contrarianism. It consists of doing the right thing at the extremes which is the contrary of what everybody else is doing. So unemtionalism is one of the basic requirements for contrarianism.”

If you didn’t read that quote carefully, I would read it again.

Is A Fed Cut Coming?

Powell’s hawkish tone in recent speeches has led the market to believe that rate cuts , at least in the next few months, are unlikely, barring a crisis. Some Fed members are not so hawkish. For example, Cleveland Fed President Beth Hammack ruled out a cut in May. But, she stated they could move as early as June if there is “ clear and convincing data” that the economy is weakening. Fed Governor Waller worries that firms may lay off workers due to tariffs. Thus, in such a scenario , he would support lower rates to “ protect the labor market .”

The Fed has little ability to use its policy to impact price changes due to tariffs. Furthermore, the jury is still out on whether tariffs are inflationary or deflationary. Therefore, a month or two of labor market deterioration could be enough to persuade the Fed to cut rates. The graph below shows that the market now assigns a 61% chance that the Fed will cut rates in June.