- Dollar rebounds as China considers tariff exemptions

- But recession concerns remain, evident by Fed rate cut bets

- Tokyo CPI inflation accelerates, boosting BoJ hike bets

- Wall Street rallies on easing trade tensions, tech boost

China Extends an Olive Branch

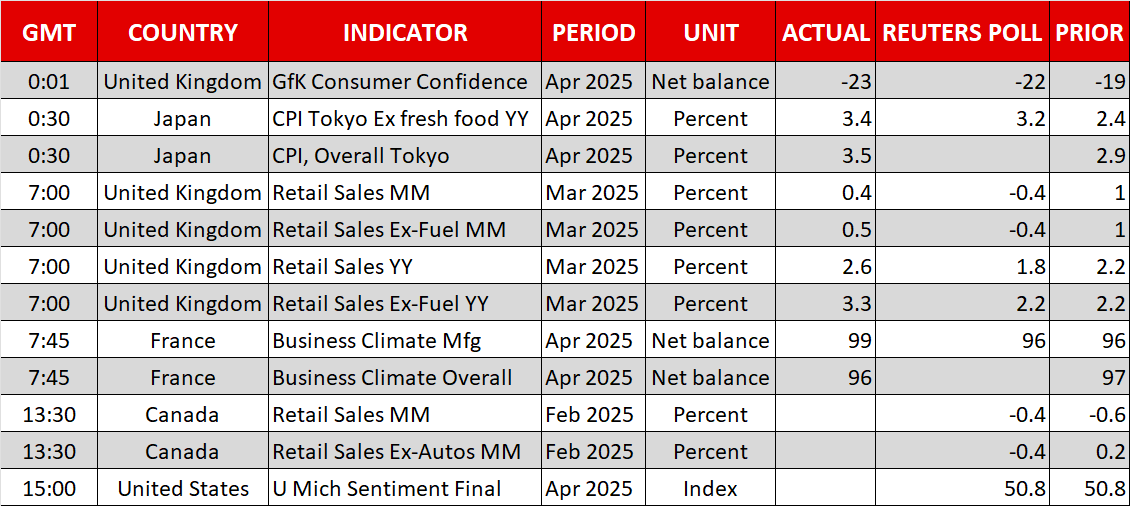

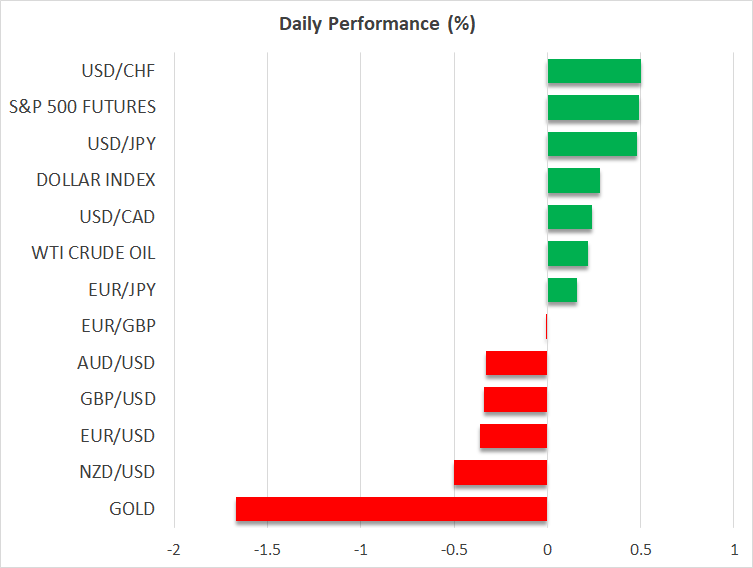

As investors keep their gaze locked on headlines surrounding Trump’s tariff rhetoric and actions, the rollercoaster-style trading continues, with the US dollar sliding against all its major counterparts on Thursday, but rebounding on Friday, gaining the most against the safe havens Japanese yen and Swiss franc .

The greenback resumed its slide on Thursday after China said that no negotiations had been held with the US on the matter of trade and urged the world’s largest economy to lift all unilateral tariff measures if they indeed want to secure common ground.

That said, Trump insisted that trade talks with China are underway, refraining from mentioning with whom he is negotiating, while during the Asian session today, a report hit the wires saying that China is considering tariff exemptions for US medical equipment and some industrial chemicals.

But Recession Worries Remain

This allowed for some relief among investors, and it was the driver behind the dollar’s rebound, putting it on course for the first positive week after a four-week beating streak. That said, looking at Fed fund futures, it seems that market participants remain concerned about the economic outlook and the likelihood of a potential recession in 2025. They are still penciling in around 85 bps worth of rate cuts by the Fed this year.

After all, Trump has already proven how unpredictable he can be. Thus, at any point in time, things could re-escalate, and another wave of anxiety could shroud the financial markets.

The talks the US is holding with South Korea and Japan could act as a precursor as to how smooth negotiations with China may be. Korea’s delegation has already said that they are aiming at sealing a deal before the freeze on reciprocal tariffs expires. Japan is also in negotiations, with Japan’s Finance Minister saying that there was no demand for currency targets. At the beginning of this month, Trump accused Japan of weakening the yen to give its exporters an advantage.

Thus, if market participants get the sense that deals could be easily sealed, risk appetite could further improve, and the dollar could gain more. The opposite may be true if negotiations with Japan, a key US ally, prove to be difficult.

Traders Increase BoJ Hike Bets After Tokyo CPI Data

Speaking about Japan, the yen is the main gainer today, benefiting not only from safe-haven flows, but also from the resumption of bets that the BoJ could indeed raise interest rates again by the end of the year.

Yesterday, Governor Ueda said that the Bank remains committed to raising interest rates, although the impact from US tariffs on the economy needs to be well scrutinized. Ueda’s view gained extra importance after the Tokyo CPI s revealed a steep acceleration in inflation . Now, Japan’s overnight index swaps (OIS) market is pointing to a strong 72% probability of another quarter-point hike by December.

Wall Street Climbs Higher Amid Risk-On Environment, Tech Boost

Hopes that trade tensions between the US and China could de-escalate helped Wall Street to add to its gains, with the tech-heavy Nasdaq gaining nearly 3%. What also helped stocks, and especially the “Magnificent 7” group of tech giants, were the better-than-expected earnings results by the AI-powered software firm ServiceNow (NYSE: NOW ). ServiceNow is a company that supplies a cloud computing platform for the creation and management of automated business workflows.

In the

S&P 500

, 157 companies have already reported their quarterly results so far, and 74% of them have beaten analysts’ estimates, giving investors another reason to increase their risk exposure.