Major Central Banks Now Aligned as Powell Signals Fed Cuts Ahead

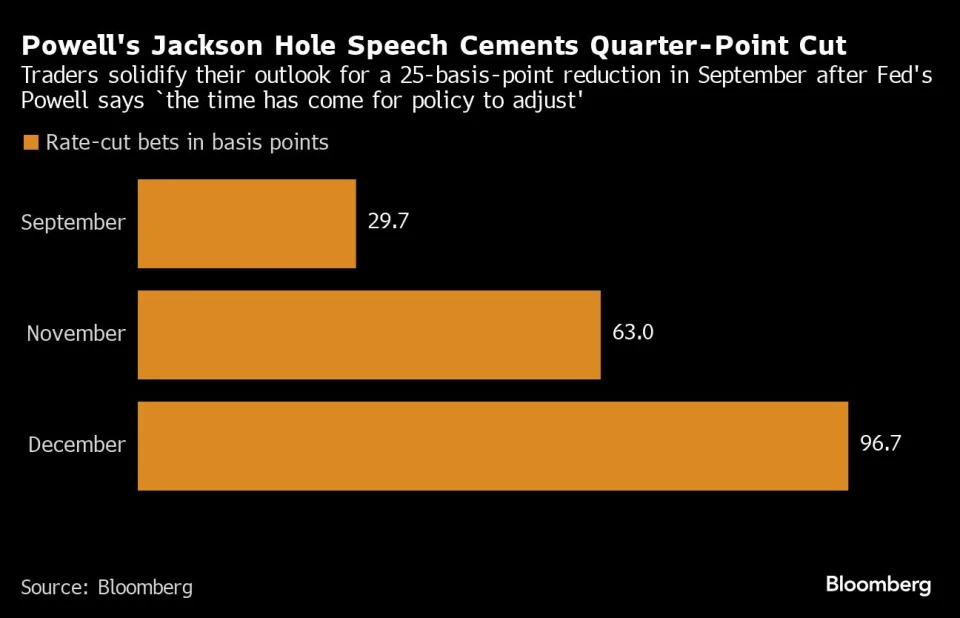

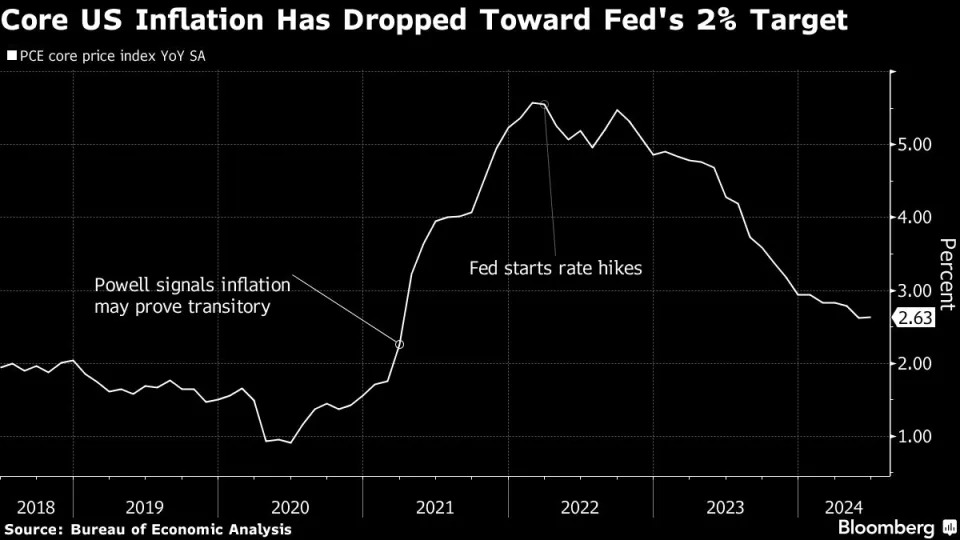

(Bloomberg) -- Officials from three of the world’s major central banks on Friday signaled they are firmly on course to lower — or continue lowering — interest rates in the coming months, marking the beginning of the end for an era of high borrowing costs as the global economy slips out of the grip of post-Covid inflation.Most Read from BloombergChicago's Migrant Surge Is Stirring Trouble for Democrats in DNC Host CitySydney Central Train Station Is Now an Architectural DestinationWith Housing Co