How to prepare for the Fed's forthcoming interest rate cuts

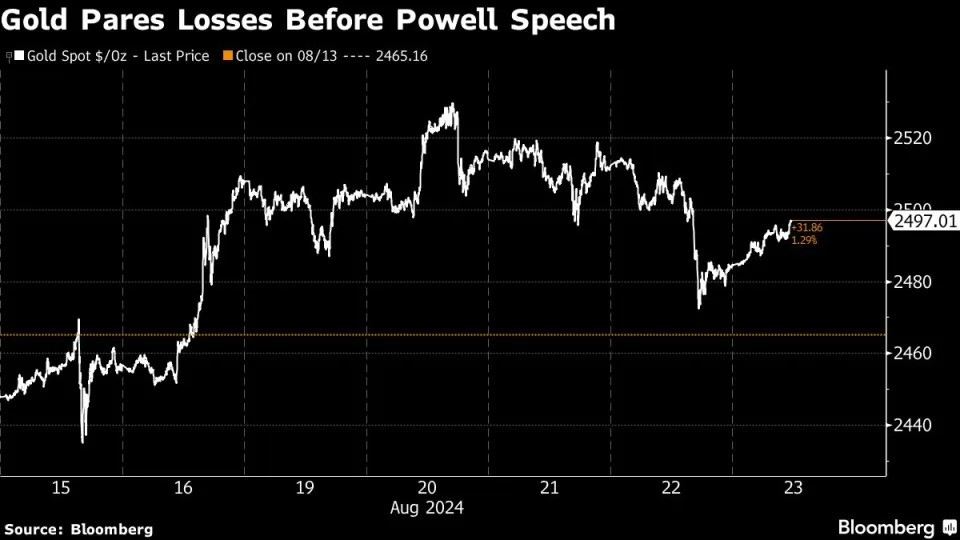

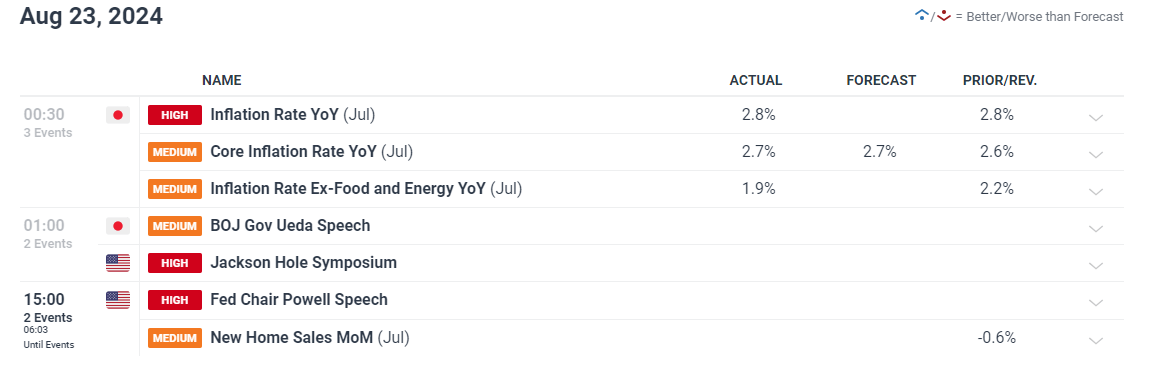

The Federal Reserve is poised to cut its benchmark interest rate next month from its 23-year high, with consequences for consumers when it comes to debt, savings, auto loans and mortgages. Right now, most experts envision three quarter-point Fed cuts — in September, November and December — though even steeper rate cuts are possible. “The time has come” for the Fed to reduce interest rates, Powell said Friday in his keynote speech at the Fed’s annual economic conference in Jackson Hole, Wyoming.